Technology key to insurance industry growth - Kaddunabbi

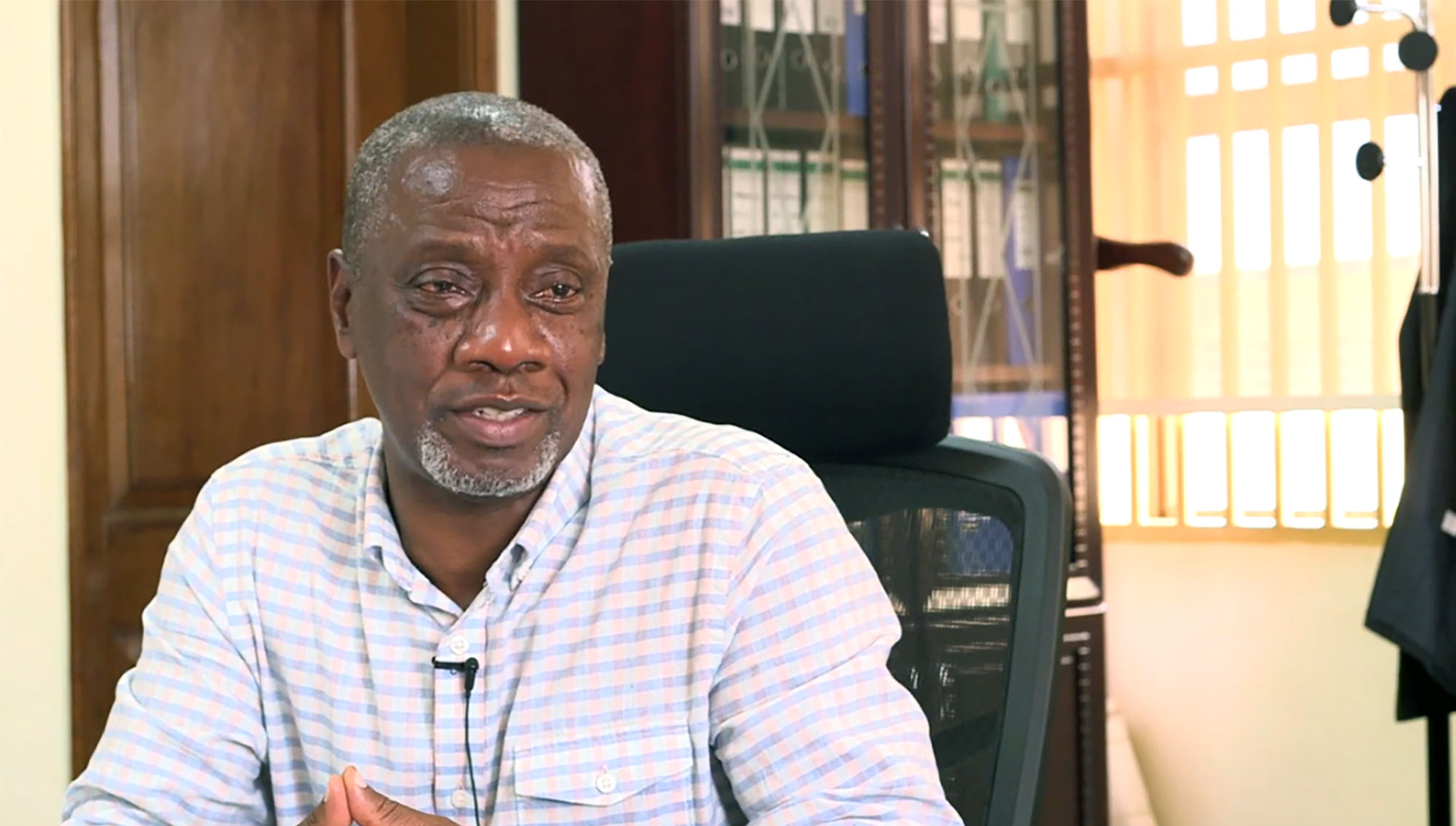

IRA boss Kaddunabbi says by leveraging technology, insurance companies can tailor their products and pricing strategies to meet specific needs, leading to improved profitability and risk management.

The insurance industry in Uganda has demonstrated resilience and adaptability over the past six months, achieving a growth rate of 12.65% in the period. This positive trend has been driven by the expansion of microinsurance, along with investments in digital technology and innovation. Business Edge spoke with Ibrahim Kaddunabbi Lubega, the CEO of the Insurance Regulatory Authority (IRA). Excerpts

You recently published the half year performance results of the insurance sector in Uganda. Can you provide an overview of the sector’s growth in the first half of 2024?

The insurance sector has shown a robust growth rate of 12.65% during this period, with gross written premiums reaching UGX933.8 billion, up from UGX828.9 billion in the same period last year. This growth has been driven by significant performances across different segments, especially life insurance and Health Membership Organizations (HMOs).

The life insurance sector saw a remarkable 22.97% increase, with premiums reaching UGX357.8 billion, while HMOs reported 21.24% growth, totaling UGX33.1 billion. These gains reflect the sector's focus on long-term financial security and improved health coverage. Additionally, our collaboration with market stakeholders and focus on regulatory improvements have contributed significantly.

In the recent years, the occurrence of fraud has been steadily growing in the insurance sector. What steps is the IRA taking to address it?

It is true that fraud, particularly in the motor insurance segment, has been a pressing issue. The IRA has implemented several proactive measures to curb fraud and enhance transparency.

A dedicated team has been established to monitor and address fraudulent activities, especially in high-risk areas like motor insurance, where fraud has become a significant concern. This team collaborates with technical experts to set best practices for pre- and post-insurance checks, aiming to catch fraud early.

Our zero-tolerance approach to fraud reflects our commitment to safeguarding both consumers and insurers, reinforcing trust across the industry. That said, we are hopeful that the introduction of digital number plates, equipped with enhanced features, is anticipated to play a significant role in curbing fraud in motor insurance.

The sector’s performance is largely pegged to brokers who are the inter-link between the client and the service provider. How has the role of brokers evolved over the years?

Indeed, brokers have become indispensable to the insurance ecosystem. Over the years, their role has expanded from simply facilitating transactions to offering personalized advisory services that enhance client understanding and trust in insurance products.

Brokers now handle an increasing volume of premiums, which grew by 15.63% recently, showing their importance in driving business. They have adapted to the evolving needs of clients by leveraging technology for quicker response times, better data management, and tailored solutions. Their role as educators and advocates has significantly bolstered market growth and helped bridge the gap between insurers and clients.

In your report, micro-insurance has experienced significant growth. What can you attribute this growth to?

Micro-insurance has indeed seen impressive growth, with premiums increasing by 32.5%, from UGX9.6 billion in 2023 to UGX13.2 billion in 2024. This growth can largely be attributed to regulatory support from the IRA and the innovative products introduced by new market players.

Additionally, we’re collaborating closely with development partners to expand access to affordable financial protection, which is essential for reaching a broader segment of Ugandans who benefit from the security micro-insurance provides. Our focus on refining guidelines has also ensured that service delivery and efficiency in this sector continue to improve.

Looking ahead, what’s your outlook for the insurance sector for the rest of the year?

Generally, the outlook is highly positive, with projected growth of at least 10% in gross premiums by year-end. We expect that ongoing innovations, particularly in areas like Marine Insurance compliance and digital transformation, will play a significant role in driving further growth.

Additionally, a stable macroeconomic environment and anticipated public investments provide strong support for this trajectory. These factors combined will help ensure that the insurance sector remains a pillar of Uganda’s economic landscape, contributing meaningfully to the country's development.

Innovation seems to be a recurring theme. Could you elaborate on the role of innovation in shaping the industry?

Innovation is absolutely vital and should be viewed as an ongoing journey rather than a one-off event. In the insurance sector, we must continuously look forward; if an insurer achieved something great yesterday, the real question is, what are they doing today, and how will they improve tomorrow? This proactive mindset is essential for staying competitive and leading the industry in adapting to new trends and technologies. By fostering a culture of innovation, insurers can better meet consumer needs, enhance service delivery, and ultimately drive sustainable growth in the market.

This involves embracing advancements in technology, such as digital platforms and data analytics, which enhance customer experiences and streamline operations. For instance, innovations in claims processing, underwriting, and customer service can significantly improve efficiency and reduce costs.

As we move forward, it’s essential for every insurer to ask themselves: What can we do today to innovate and improve tomorrow? This forward-thinking approach will be key to ensuring the industry's resilience and relevance in a rapidly evolving market.

Lastly, what role does technology play in the future of Uganda’s insurance industry?

Technology is set to play a transformative role in the future of Uganda’s insurance industry, influencing various aspects of operations, customer engagement, and product delivery. First of all, it (tech) enables insurers to provide more personalized and efficient services. Digital platforms and mobile applications allow customers to easily access information, manage policies, and submit claims. This convenience will likely lead to higher customer satisfaction and loyalty.

Also, advanced data analytics tools can help insurers better understand customer behavior, risk profiles, and market trends. By leveraging this data, companies can tailor their products and pricing strategies to meet specific needs, leading to improved profitability and risk management.

Additionally, automation of processes, such as underwriting and claims handling, can significantly reduce operational costs and processing times. This efficiency allows insurers to allocate resources more effectively and respond swiftly to customer inquiries and claims.