DTB customers to receive cash at no cost

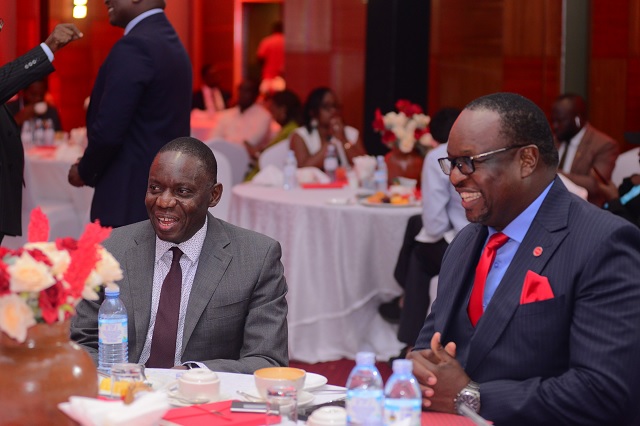

DTB Uganda CEO Godfrey Sebaana (R), exchanges signed documents with Samir Vidhate, the CEO of Xpress Money, in Kampala yesterday.

Diamond Trust Bank Uganda (DTB) has partnered with Xpress Money, an international money transfer service, to enable customers to receive money in over 170 countries worldwide at no cost.

The partnership represents a key step in reducing the barriers associated with sending money and receiving money as it aligns with the United Nations Sustainable Development Goal 10, which seeks to reduce inequalities by making remittances more affordable.

The development is especially significant for Uganda, one of the largest recipients of remittances in Sub-Saharan Africa, with an inflow of approximately $1.4 billion in 2023.

- DTB Uganda’s Chief Executive Officer, Godfrey Sebaana, underscored the importance of this service for Ugandans abroad and their families at home.

“We are thrilled to join hands with Xpress Money to boost our remittance offerings. At DTB Uganda, we recognize that remittances are essential lifelines for many, from covering school fees to healthcare costs and even basic living expenses,” Sebaana said.

He noted that this partnership would not only facilitate critical financial inflows but also contribute to a more financially inclusive economy.

- The overall cost of remitting money abroad remains high, particularly for smaller transfers or regions with limited access to banking services.

Money transfer fees/charges can vary widely depending on the service provider, the destination country, and the method of sending such as online or via mobile money. Some providers have hidden costs that are not always immediately apparent to the sender, including withdrawal charges imposed on the recipient at the point of withdrawing the cash.

Yet, remittances play a crucial role in Uganda, often covering essentials like education, healthcare, and housing. By eliminating charges imposed on the recipient, this partnership between DTB and Xpress Money enables greater disposable income for families that rely on funds from abroad, providing an economic buffer for countless households.

The service offers a variety of transfer options, including cash-to-cash, direct account credits, and mobile wallet deposits, ensuring convenient and secure options for Ugandans in the diaspora to support their families at no charge for the recipient.

Samir Vidhate, CEO of Xpress Money, highlighted the partnership’s impact on financial connectivity for customers around the world.

- “Our partnership with DTB Uganda reflects our dedication to providing convenient, secure remittance options for customers globally. We are pleased to extend our services to DTB Uganda’s customers, making it easier and more affordable for them to send money home. Together, we aim to simplify remittances and strengthen the connection between families across borders,” Vidhate stated.

- The partnership is also part of DTB Uganda’s broader strategy focused on digital transformation and expanding diaspora banking services. By aligning with fintech leaders, DTB aims to refine its remittance solutions to meet the needs of the diaspora market.

The bank’s efforts in this space demonstrate a commitment to making global remittances more efficient and accessible, driving Uganda toward a more resilient, financially inclusive economy.

Aligned with the UN’s goal of reducing remittance transfer costs to below 3% by 2030, DTB and Xpress Money’s zero-cost service is poised to bridge financial gaps, empower Ugandan communities, and enhance economic equality.

For many Ugandans, this service represents not only a cost-saving measure but also a stronger, more affordable connection to loved ones across borders.