Stanbic’s FlexiPay starts global money transfer

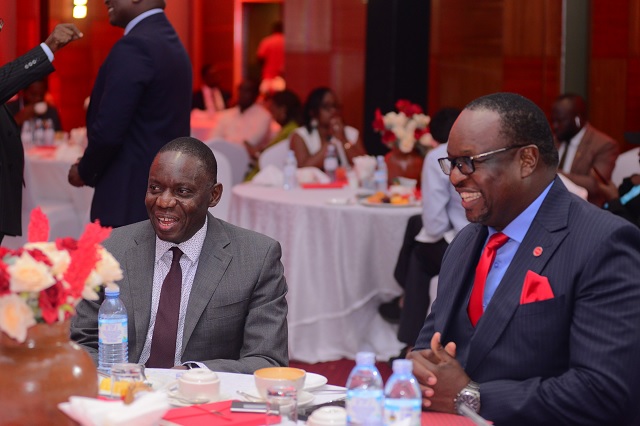

DREAM TEAM: Representatives of Flexipay, IFAD, and Upesi Money Transfer, pose for a group photo at the launch of the money transfer service.

Ugandans working in the United Arab Emirates, the United Kingdom, the United States, South Africa, Kuwait, and more than a dozen other countries can now send money home, thanks to a new partnership between FlexiPay, Stanbic Bank’s digital payment platform, the International Fund for Agricultural Development (IFAD), and Upesi Money Transfer, a regional payments company.

Officials said in a press release that the initiative would facilitate FlexiPay users to make seamless international money transfers to and from Uganda at very competitive rates.

Josephine Nakato Kasacca, head of Customer Experience and Operations at FlexiPay, said that effective June 14, 2024, FlexiPay customers have been using the platform to send money to more than 20 countries and plans are underway to expand to 70 by December this year.

- Some of the other countries from which Ugandans can receive money include Kenya, Qatar, Oman, France, Canada, Israel, South Korea, India, Germany, Ireland, the Netherlands, Bahrain, Australia, and Poland.

Experts say that remittances (commonly referred to as kyeyo) are not just financial transfers; they are essential drivers of economic stability, poverty alleviation, and development in many developing countries.

According to Bank of Uganda’s 2022 Inward Personal Transfers Report, about 65% of personal transfers was used to pay for expenses including general household purchases and payment of school fees, while about 34% went towards house construction and land purchases.

- The same report showed that about 5% of remittances came from the Middle East, about 21% came from inside Africa,15% came from Europe, and another 15% came from North America.

Official statistics from the Ministry of Finance, Planning and Economic Development indicate that Uganda’s remittances market is expected to top USD1.3 billion by 2027.

However, the high cost of sending remittances – currently standing at 6% or more – has been a major concern, resulting from lack of competition as the few companies can charge what they want without losing customers.

The United Nations Sustainable Development Goals (UNSDGs) are aiming at reducing the cost of sending remittances to as low as 3% by 2030.

Julius Okwana, Upesi Money Transfer's Country Manager, emphasized their commitment to use their extensive regional and global network to simplify remittances processes so as to drive financial inclusion in the country.

- David Berno, the head of Remittance and Inclusion at IFAD, also underscored the important role that remittances have been playing in reducing poverty and enhancing food security in developing countries.

- “We are excited to be affiliated with this campaign because money remittances enable families to meet their basic needs, such as food, shelter, and education, and can also contribute to local economic growth through increased consumption and investment.

“By supporting money remittances, IFAD aims to promote financial inclusion, empower smallholder farmers and rural entrepreneurs, and ultimately contribute to sustainable development and poverty reduction,” Berno added.