Anxiety As Donor Aid to Uganda Slumps

Foreign aid drops by 30%

Declining donor aid means a higher tax burden on citizens and more foreign debt to bankroll notoriously high public expenditure. Concern is rising as donor cash continues to take a downward slide, which analysts say reflects the escalating levels of donor fatigue and a vote of no confidence over corruption, human rights abuses and fiscal indiscipline.

Latest statistics from the Organisation for Economic Co-operation and Development (OECD) indicate that foreign aid in the form of Official Development Assistance (ODA) to Uganda has continued to slump, dropping by 30% from $2,961 in 2015 to $2,046 in 2022.

ODA refers to the financial flows, loans and grants - to developing countries from official State agencies abroad for the promotion of economic development and the welfare of citizens in the recipient countries.

- In 2022, total ODA to Uganda dropped by more than USD900 million, from USD2,961 a year before, to USD2,046, while total multilateral assistance 'money channeled through organisations' dropped to USD1,235 million from USD1,994 in 2021.

Whereas the report points to the fact that ODA to Sub-Saharan Africa was generally lower, development assistance to all Uganda's EAC counterparts actually increased in 2022 compared to a year before, with Kenya currently enjoying the lion's share of ODA in the region.

Why aid is cut: There are various reasons why donors may tighten their aid taps, some of which include donor fatigue, human rights and governance concerns, and poor accountability standards in the recipient countries.

- The report, titled; Geographical Distribution of Financial Flows to Developing Countries 2023: Disbursements, Commitments, Country Indicators, shows that ODA from the Netherlands and Norway to Uganda saw the biggest drop, from USD458 million in 2021 to minus USD351 million and minus $214 in 2022 respectively.

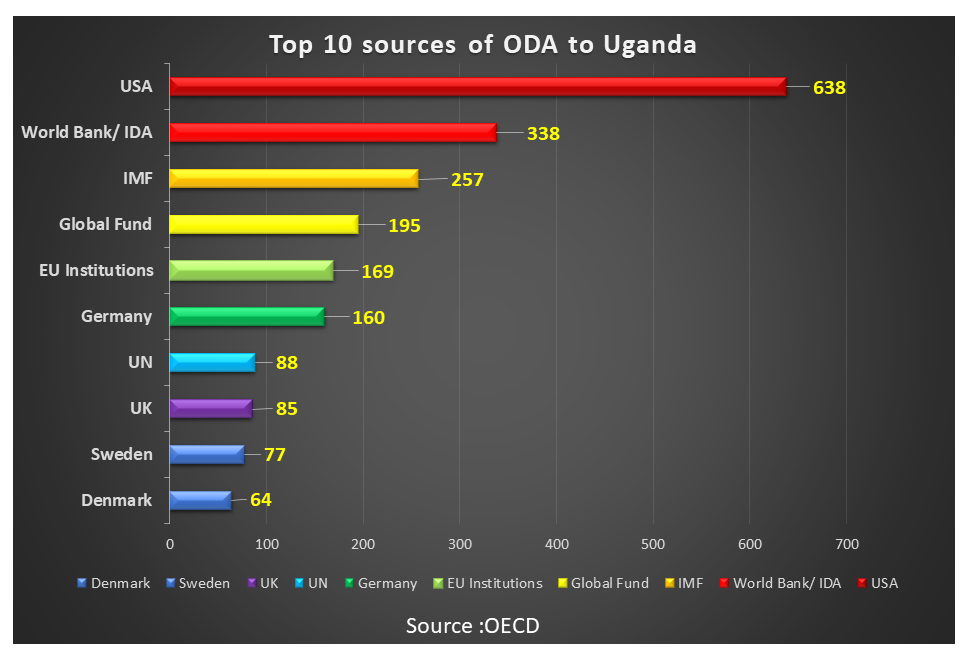

statistics from the Organisation for Economic Co-operation and Development (OECD)

statistics from the Organisation for Economic Co-operation and Development (OECD) However, ODA from Germany to Uganda topped $160 million in 2022, compared to just $44 in 2015, making the country one of Uganda's most important development partners currently, though the bulk of the ODA was channeled directly into development projects rather than budget support. All indications are that Kenya has now replaced Uganda as the donors' "blue-eyed bond" in the region. The country received a total of $1,896m in total ODA and $1,157 million from the World Bank's International Development Association, compared to Uganda's rather meager $338m. However, ODA from the European Union institutions to Uganda climbed to $170m, though still lower than Kenya's $180m.

Negatives and positives: Whereas some economists such as Jeffery Sachs are adamant that aid is a vital driver of economic growth and development, others argue against it saying it engenders corruption and a dependency syndrome, which have adversely affected the development of poor countries. Even Uganda's top government officials including President Museveni, have often argued that time has come for Uganda and Africa to be 'weaned off' donor aid to become self-reliant.

However, reduction in donor aid largely means a higher tax burden on citizens and undesirable outcomes in terms of social services delivery. For example, the health sector is currently Uganda's biggest beneficiary of donor aid, followed by humanitarian activities, according to the report.

While Uganda's revenue performance has continued to improve, the main concern for analysts is that the exorbitantly high cost of administration coupled with a narrow tax net means that the few official tax payers are increasingly shouldering a heavier tax burden. To make matters even worse, Uganda's tax revenue system has been negatively affected by massive tax exemptions and diminishing political support for tax collection efforts, according to the World Bank.

- Due to inadequate tax revenues and falling ODA, the government has had no other choice but to rely more on borrowing from countries such as China. Official statistics show that Uganda's current external debt stands at a record 50% of GDP.

- World Bank squeeze: The World Bank has, over the last few decades, been the mainstay of Uganda's loans to finance large scale projects particularly infrastructure and human capital development.

However, the Institution recently announced that it would not be releasing any new financing to Uganda, citing human rights concerns, a development that has thrown the proverbial cat among pigeons with the local currency taking a severe beating. Although inflation is expected to slow, it is projected to remain above the Central bank's medium-term target of 5%, according to the Uganda Economic Outlook published by the African Development Bank.

Thanks to the rising levels of mistrust by donors because of corruption, most ODA to Uganda now comes in the form of multilateral assistance (through organisations to support projects directly) rather than budget support. In 2015, for example, multilateral support was just $635m but it almost doubled to $1,235 in 2022. This trend observers say, is indicative of donors' continuing disillusionment with the Government's deficiencies in public accountability.

Generally, the report shows that the USA continued to be the world's largest provider of ODA in 2022 with a contribution of USD55.3 billion, followed by Germany (USD 35.0 billion), Japan (USD 17.5 billion), France (USD 15.9 billion) and the United Kingdom (USD 15.7 billion). However, net ODA to sub-Saharan Africa was USD29 billion, indicating a decline of about 8% in real terms.