Unit trusts total assets soar to UGX 3.5 trillion

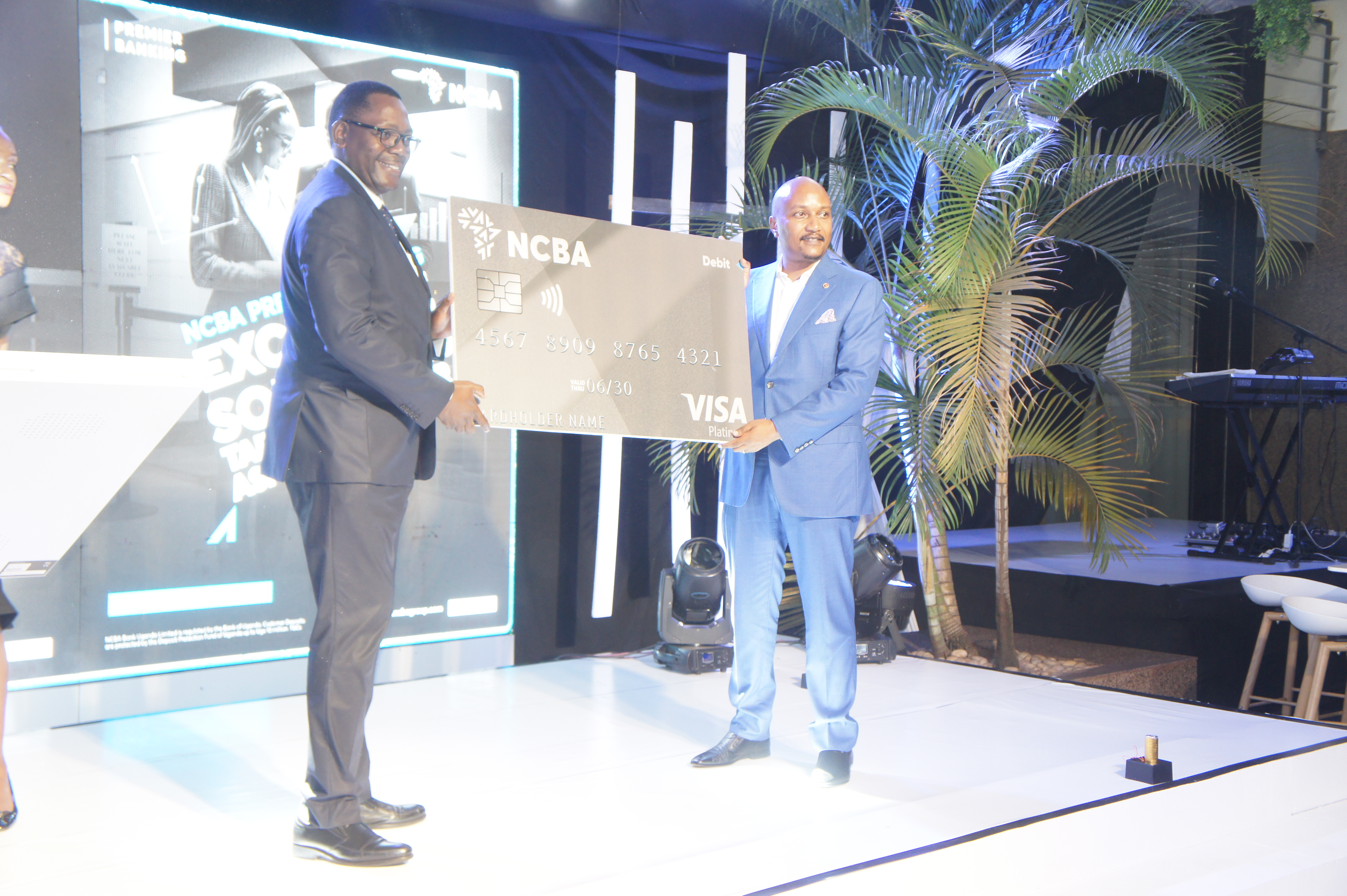

Henry Musasizi, the Minister of State at the Ministry of Finance, launches Easy Portal, a new system that enables the digital purchase of treasury bonds, in Kampala recently. Looking on is Josephine Okui Ossiya (L), the CMA CEO, and Paul Bwiso, the USE CEO. Unit trusts predominantly invest in treasury bonds currently.

Uganda's financial assets under management (AUM) in the Collective Investment Scheme (CIS) market have hit an all-time high, reaching UGX 3.5 trillion (approximately US$ 945.4 million) as of September 2024.

This milestone, detailed in the Capital Markets Authority (CMA)'s latest quarterly bulletin, reflects a rising wave of interest among Ugandans in CIS as a structured, low-risk investment option.

The growth rate is remarkable, marking a 10.5% increase from UGX 3.18 trillion in June 2024 and a year-on-year jump of 54.1% from UGX 2.3 trillion (US$ 613.4 million) in September 2023. This surge underscores the growing appeal of collective investment as an accessible vehicle for wealth accumulation in Uganda.

- Collective investment schemes or unit trusts, are investment funds that pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, and money market instruments.

Josephine Okui Ossiya, the CMA Chief Executive Officer, attributes the impressive growth to a blend of increased investor awareness and robust regulatory protections. “Ugandans are recognizing the benefits of investing through pooled savings vehicles,” Ossiya noted.

“The regulatory framework has instilled confidence among investors, who are assured of the protection afforded by investing in regulated financial products, such as CIS.” The confidence boost, Ossiya emphasized, has been a game-changer in attracting more participants to the market.

- One factor behind this growth is Uganda’s National Social Security Fund (NSSF) midterm access program, which has allowed qualifying members to access part of their savings before retirement. The funds released through NSSF midterm withdrawals have channelled some investments into CIS, creating an opportunity for individuals to grow their savings with a diversified portfolio. This strategic reinvestment has driven CIS adoption and amplified the collective pool of assets.

At the end of September 2024, Government of Uganda bonds accounted for 63.3% of total AUM. The number of funded CIS accounts has risen to 103,950 by September 2024, a 12.8% increase from 92,165 in June 2024. This trend demonstrates that Ugandans from various economic backgrounds are joining the CIS sector in growing numbers. With many investors being first-time participants in Uganda's capital markets, CIS serves as an entry point, offering relatively low initial investment requirements and professional fund management.

Uganda’s CIS sector now stands as the second-largest in East Africa, trailing only Kenya, which boasts assets under management totalling US$ 1.97 billion. Uganda’s CIS assets account for approximately 2% of its GDP, comparable to Kenya’s 2% and significantly higher than Tanzania’s 1.2%. This ranking not only highlights Uganda’s growth within the East African capital markets but also signals the potential for further expansion, as awareness and accessibility improve.

Financial analysts credit the CMA’s regulatory efforts for much of this success. By setting stringent rules and maintaining oversight, the CMA has created a secure environment that encourages more Ugandans to invest. As investment literacy spreads and more people understand the benefits of diversification through CIS, the sector is projected to grow even further.

This surge in Uganda’s CIS market not only reflects rising investor confidence but also aligns with national economic goals. With assets at UGX 3.5 trillion, the sector is supporting financial inclusion, enabling individuals to save, invest, and secure their financial futures.

- By expanding participation across socioeconomic levels, the CIS sector strengthens Uganda's financial foundation and creates an environment conducive to sustainable economic growth.

- The future of Uganda’s CIS market appears bright, with CMA poised to introduce more investor education initiatives. "As more Ugandans learn about the structured opportunities CIS offers, we expect even broader participation," said Ossiya. "Our focus is to ensure transparency, security, and growth in Uganda’s capital markets for generations to come."

The investment schemes market in Uganda is dominated by UAP Old Mutual, Sanlam Investments, Britam Asset Managers, SBG Securities Limited and XENO.